The Manhattan Institute, a conservative New York–based think tank, has estimated that as many as 10 million jobs in the U.S.–and $400 billion in annual economic wealth–depend in some way on the shale-oil boom, many of them high-skill, high-pay factory jobs. Those jobs help fuel others in their communities. Energy jobs pay more than double the average annual wage across all industries in America. Yet in a recovery that is producing jobs for Ph.D.s and burger flippers but little in between, energy-sector employment is one of the few bright spots for the middle class. Not only is there a huge consumer windfall in the form of lower prices, but the domestic energy sector’s share of jobs is really quite small, just 1.4% of total nonfarm employment in the U.S. Most economists will say, rightly, that lower oil prices are on balance a short-term net gain to the U.S. Lower investment means fewer jobs in the industry. oil business this year London-based Capital Economics is estimating a much steeper decrease, as much as 60% to 70% in the first half of the year, if prices stay as low as they are. A recent Goldman Sachs report estimated a 15% drop in spending within the U.S. That’s why a lot of future shale-oil production is already being slashed. Shale oil is relatively expensive to get out of the ground much of it requires prices of around $70 a barrel to be economical. Plunging oil prices are pressuring the American shale-oil and -gas producers responsible for the domestic energy boom–which comes with its own ramifications for the economy. consumers and companies may well be somewhat offset by a slower China, given that so many American businesses depend on sales in the Chinese market.īut there’s another factor at play.

The benefit from falling oil prices for U.S. Given that China has provided the majority of global growth since the 2008 financial crisis, Wall Street is spooked. First, China is now the world’s second largest economy and its most voracious energy consumer–and its economic slowdown has dented oil demand. So why isn’t cheap oil making the markets happy? There are two complicating factors. was not in recession–in 1986 and again in the late 1990s–growth jumped the following year. In the previous two cases in which oil prices fell more than 50% when the U.S. GDP growth, which would push total growth up toward 3.5%–a level that should sustain the broad-based job creation we’ve seen over the past few months. Goldman Sachs estimates low oil prices could add as much as a half-point to U.S. That should boost spending, and thus boost job creation, in a broad array of industries. That cash can now be spent on a new car–or a washing machine, an electronic gadget, clothes or a few dinners out. American households with oil heat could save $767 each this winter. And it’s effectively a progressive one, since the biggest beneficiaries will be working- and middle-class people who spend a disproportionate amount of their income on gas for their cars and heating fuel for their homes. The decline in prices is the equivalent of a $125 billion tax cut.

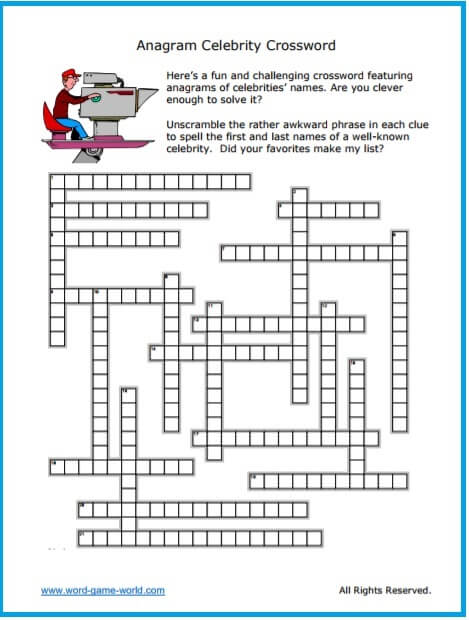

UNSCRAMBLE REJOIN FREE

SHARE Illustration by Ben Wiseman for TIME Exploring the ramifications of cheap oil for the U.S., the world-and youĬheaper oil will put money in consumers’ pockets–and shed new light on the quality of the recoveryĪt first look, the collapse in oil prices over the past year, from $107 per barrel in June to below $50 a barrel today, seems like the proverbial free lunch for American consumers.

0 kommentar(er)

0 kommentar(er)